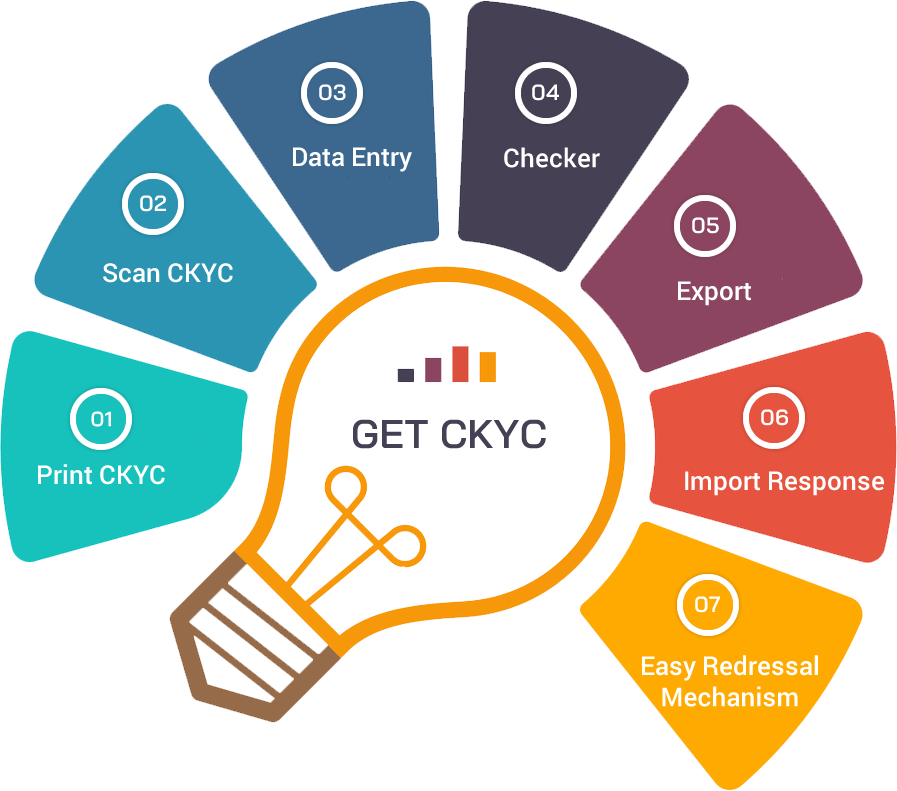

We offer the system for Fast and Accurate Compliance to CKYC / KRA

As per the directives of the Ministry of Finance, the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) are to perform the functions of the Central KYC Records Registry (CKYCR). The CERSAI will receive, store, safeguard and retrieve know your customer (KYC) records in digital form for a client, as against other KYC Registration Agencies (KRAs) such as Computer Age Management Services (CAMS) and Karvy, which maintain KYC information provided by investors on their individual systems and verified in person.

The main objective of CKYC is to provide a platform which enables investors to complete their KYC only once before interacting with various entities in the financial services sector. Once CKYC is complete for an investor, he/she is allotted a 14-digit unique KYC identification number (KIN) which needs to be quoted by the investor while conducting any transaction.